[{“available”:true,”c_guid”:”5321e95e-622e-44b9-b610-6c060fa4d327″,”c_author”:”hvg.hu”,”category”:”tudomany”,”description”:”A kétgyermekes családmodell vesztett a népszerűségéből, jelentősen nőtt az egy gyereket vállalók aránya.”,”shortLead”:”A kétgyermekes családmodell vesztett a népszerűségéből, jelentősen nőtt az egy gyereket vállalók aránya.”,”id”:”20211104_gyermekvallalas_ksh_statisztika”,”image”:”https://img2.hvg.hu/image.aspx?id=5321e95e-622e-44b9-b610-6c060fa4d327&view=ffdb5e3a-e632-4abc-b367-3d9b3bb5573b”,”index”:0,”item”:”cb882479-61fa-437b-a1f2-611185d2e297″,”keywords”:null,”link”:”/tudomany/20211104_gyermekvallalas_ksh_statisztika”,”timestamp”:”2021. november. 04. 07:47″,”title”:”A mai harmincas nőknek akár az ötöde is gyermektelen maradhat”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”a9f0dbf4-a680-4dec-b99a-8002c587a2cd”,”c_author”:”Hamvay Péter”,”category”:”itthon”,”description”:”Ez a HVG hetilap ajánlója.”,”shortLead”:”Ez a HVG hetilap ajánlója.”,”id”:”202144_a_hiany_hienai”,”image”:”https://img2.hvg.hu/image.aspx?id=a9f0dbf4-a680-4dec-b99a-8002c587a2cd&view=ffdb5e3a-e632-4abc-b367-3d9b3bb5573b”,”index”:0,”item”:”f9cbfde9-d369-4c55-8905-1e8f3d86f644″,”keywords”:null,”link”:”/itthon/202144_a_hiany_hienai”,”timestamp”:”2021. november. 04. 08:58″,”title”:”Hamvay Péter: A hiány hiénái”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”4ba04299-2b3f-4890-86bb-fa5ed7deefc8″,”c_author”:”HVG”,”category”:”gazdasag”,”description”:”Észrevették a magyar pénzemberek az egészségügyben és az élettudományokban rejlő profitot. Egyre több jel utal arra, hogy ennek kiaknázását az Orbán-kormány is elő akarja segíteni a hozzá közel állók számára.”,”shortLead”:”Észrevették a magyar pénzemberek az egészségügyben és az élettudományokban rejlő profitot. Egyre több jel utal arra…”,”id”:”20211103_A_Fidesz_meglatta_az_uzleti_lehetoseget_a_maganegeszsegugyben”,”image”:”https://img2.hvg.hu/image.aspx?id=4ba04299-2b3f-4890-86bb-fa5ed7deefc8&view=ffdb5e3a-e632-4abc-b367-3d9b3bb5573b”,”index”:0,”item”:”8e53cff9-abe8-490b-be14-4538de03bd39″,”keywords”:null,”link”:”/gazdasag/20211103_A_Fidesz_meglatta_az_uzleti_lehetoseget_a_maganegeszsegugyben”,”timestamp”:”2021. november. 03. 13:28″,”title”:”A Fidesz meglátta a(z üzleti) lehetőséget a magánegészségügyben”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”9bc2687a-b972-4dbe-ae06-454f5f02ba16″,”c_author”:”hvg.hu”,”category”:”itthon”,”description”:”A Húszezren a tiszta választásért 2022-ben szervezet célja, hogy az ország összes szavazókörébe találjanak legalább két embert.”,”shortLead”:”A Húszezren a tiszta választásért 2022-ben szervezet célja, hogy az ország összes szavazókörébe találjanak legalább két…”,”id”:”20211104_szavazatszamlalo_ellenzeki_partok_20k22″,”image”:”https://img2.hvg.hu/image.aspx?id=9bc2687a-b972-4dbe-ae06-454f5f02ba16&view=ffdb5e3a-e632-4abc-b367-3d9b3bb5573b”,”index”:0,”item”:”4ffce56b-1dae-4d9a-8ea7-78b51c7f4abd”,”keywords”:null,”link”:”/itthon/20211104_szavazatszamlalo_ellenzeki_partok_20k22″,”timestamp”:”2021. november. 04. 06:53″,”title”:”Már van közel 10 ezer szavazatszámlálója az ellenzéki pártoknak”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”edda3b43-351e-420f-9102-1d87124ee899″,”c_author”:”Lengyel Miklós”,”category”:”gazdasag”,”description”:”A vakcinaturizmus egyik kedvelt célpontja Belgrád.nn”,”shortLead”:”A vakcinaturizmus egyik kedvelt célpontja Belgrád.nn”,”id”:”20211103_vakcinaturizmus_oroszorszag_szputnyik”,”image”:”https://img2.hvg.hu/image.aspx?id=edda3b43-351e-420f-9102-1d87124ee899&view=ffdb5e3a-e632-4abc-b367-3d9b3bb5573b”,”index”:0,”item”:”127acda1-cd30-4cff-b7aa-08d576cf5b01″,”keywords”:null,”link”:”/gazdasag/20211103_vakcinaturizmus_oroszorszag_szputnyik”,”timestamp”:”2021. november. 03. 06:59″,”title”:”Külföldre mennek az oroszok, hogy ne Szputnyikkal oltsák be őket”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”3b222447-74e8-40d6-863b-13bdcf04ca17″,”c_author”:”hvg.hu”,”category”:”tudomany”,”description”:”Ha most gondolkozik azon, hogy 21,5”-es inteles iMacet venne, akkor bizony elkésett, vagy legalábbis csak nagy szerencsével juthat ilyenhez. Az Apple ugyanis különösebb hírverés nélkül leállította e modell forgalmazását.”,”shortLead”:”Ha most gondolkozik azon, hogy 21,5”-es inteles iMacet venne, akkor bizony elkésett, vagy legalábbis csak nagy…”,”id”:”20211104_apple_imac_215_inches_inteles_modell_kivonasa”,”image”:”https://img2.hvg.hu/image.aspx?id=3b222447-74e8-40d6-863b-13bdcf04ca17&view=ffdb5e3a-e632-4abc-b367-3d9b3bb5573b”,”index”:0,”item”:”3397329b-d296-4a53-8410-2ab92f7c4917″,”keywords”:null,”link”:”/tudomany/20211104_apple_imac_215_inches_inteles_modell_kivonasa”,”timestamp”:”2021. november. 04. 10:03″,”title”:”Csendben kivégzett az Apple egy népszerű iMac modellt”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”f6ad7733-d3f8-4f22-bf58-a4683a495a9a”,”c_author”:”HVG360″,”category”:”360″,”description”:”A vezető európai lap azt jósolja, hogy az unió csak nehezen tud kompromisszumot kialakítani Lengyelországgal, mert a Brexit fájó tanulságai ugyan rugalmasabb klubot indokolnának, ám ennek útjában állnak az alapelvek.”,”shortLead”:”A vezető európai lap azt jósolja, hogy az unió csak nehezen tud kompromisszumot kialakítani Lengyelországgal, mert…”,”id”:”20211104_FT_Az_EUnak_nem_lesz_konnyu_dulore_jutnia_a_lengyelekkel”,”image”:”https://img2.hvg.hu/image.aspx?id=f6ad7733-d3f8-4f22-bf58-a4683a495a9a&view=ffdb5e3a-e632-4abc-b367-3d9b3bb5573b”,”index”:0,”item”:”cd402949-ec98-45e4-b248-3a59731bfb52″,”keywords”:null,”link”:”/360/20211104_FT_Az_EUnak_nem_lesz_konnyu_dulore_jutnia_a_lengyelekkel”,”timestamp”:”2021. november. 04. 08:13″,”title”:”FT: Az EU-nak nem lesz könnyű dűlőre jutnia a lengyelekkel”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:true,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null},{“available”:true,”c_guid”:”dd2d5433-2bf1-4d0f-857a-a29b4f58a850″,”c_author”:”hvg.hu”,”category”:”elet”,”description”:”67 éves korában, hosszan tartó súlyos betegség után hunyt el. “,”shortLead”:”67 éves korában, hosszan tartó súlyos betegség után hunyt el. “,”id”:”20211104_Meghalt_Mihalyfalvi_Mihaly_szinkronrendezo”,”image”:”https://img2.hvg.hu/image.aspx?id=dd2d5433-2bf1-4d0f-857a-a29b4f58a850&view=ffdb5e3a-e632-4abc-b367-3d9b3bb5573b”,”index”:0,”item”:”2a7a3af6-04ac-490e-8d51-85c0c50b727a”,”keywords”:null,”link”:”/elet/20211104_Meghalt_Mihalyfalvi_Mihaly_szinkronrendezo”,”timestamp”:”2021. november. 04. 12:43″,”title”:”Meghalt Mihályfalvi Mihály szinkronrendező”,”trackingCode”:”RELATED”,”c_isbrandchannel”:false,”c_isbrandcontent”:false,”c_isbrandstory”:false,”c_isbrandcontentorbrandstory”:false,”c_isbranded”:false,”c_ishvg360article”:false,”c_partnername”:null,”c_partnerlogo”:”00000000-0000-0000-0000-000000000000″,”c_partnertag”:null}]

The number of editorial boards independent of power is steadily declining, and those that do still exist are trying to stay afloat under growing headwinds. At HVG, we persevere and never give in to pressure, bringing local and international news every day.

That’s why we ask you, our readers, to support us! We promise to continue to give you the best we can!

Recommended from the first page

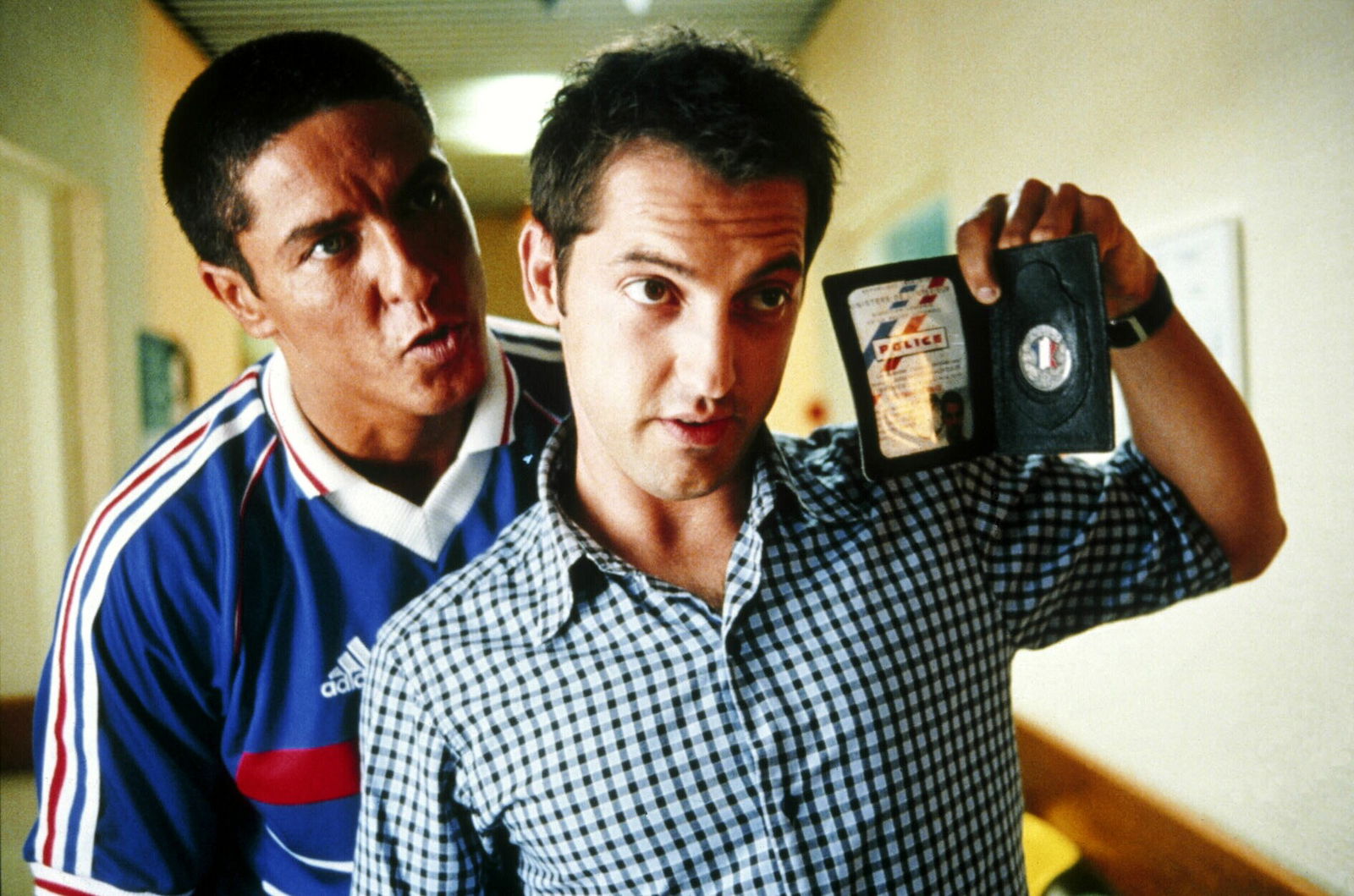

Whoever gives money to Urban today is stupid. inappropriate.