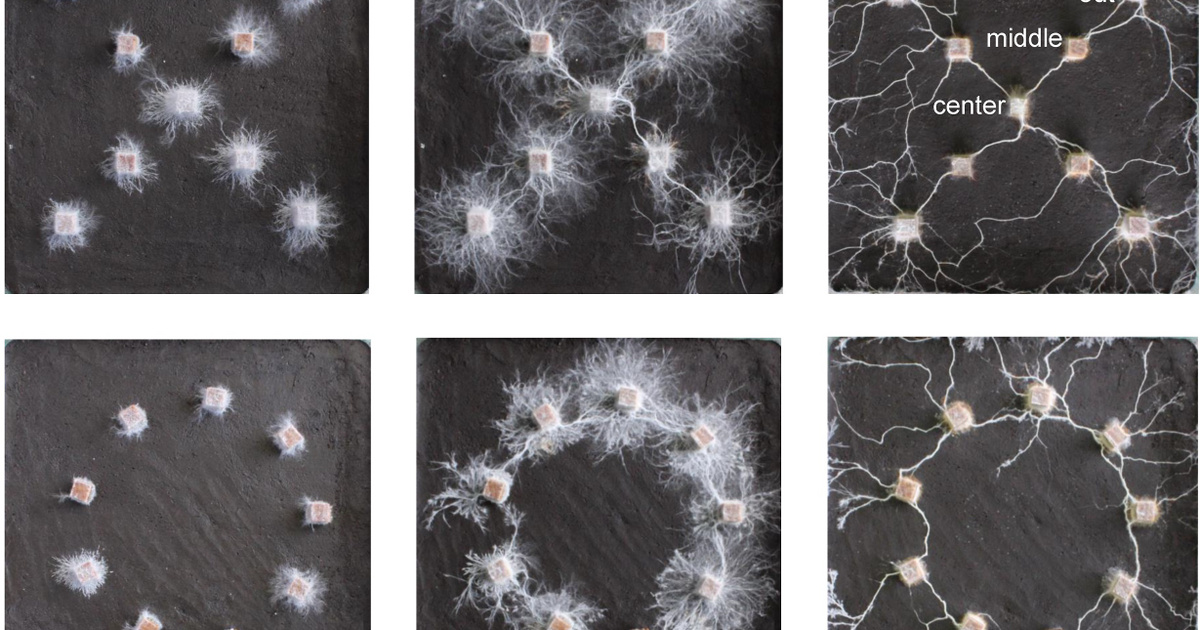

The European Union plans to ban Russian oil, and many other countries are avoiding importing energy from the country. However, there is a possibility that the entire package of sanctions may be unenforceable, at least according to Shell, one of the world’s largest oil companies, with no way to trace the country of origin of the oil products.

The origin of any crude oil, including Russian crude oil, cannot be determined if it is refined elsewhere and resold as a product of that country.

Ben van Beurden, CEO of Shell, said: interested in trade Technical problems with the planned EU ban.

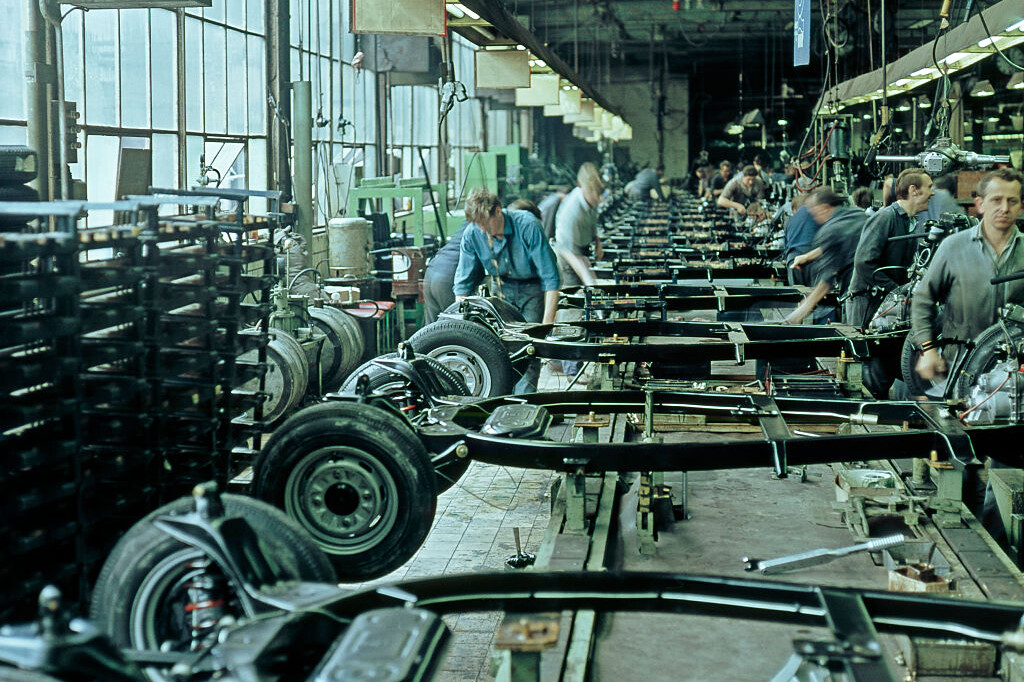

Global supply chains are very complex

“We do not currently have systems in the world that can track whether a particular molecule comes from a geological formation in Russia,” he explained at a press conference about the oil company’s quarterly earnings report.

Van Beurden’s remark also highlights the difficulty of imposing sanctions on Russian oil due to the complexity of global supply chains. However, the European Union proposed a ban on Russian oil imports this week as part of the sixth package of sanctions against the country over the invasion of Ukraine.

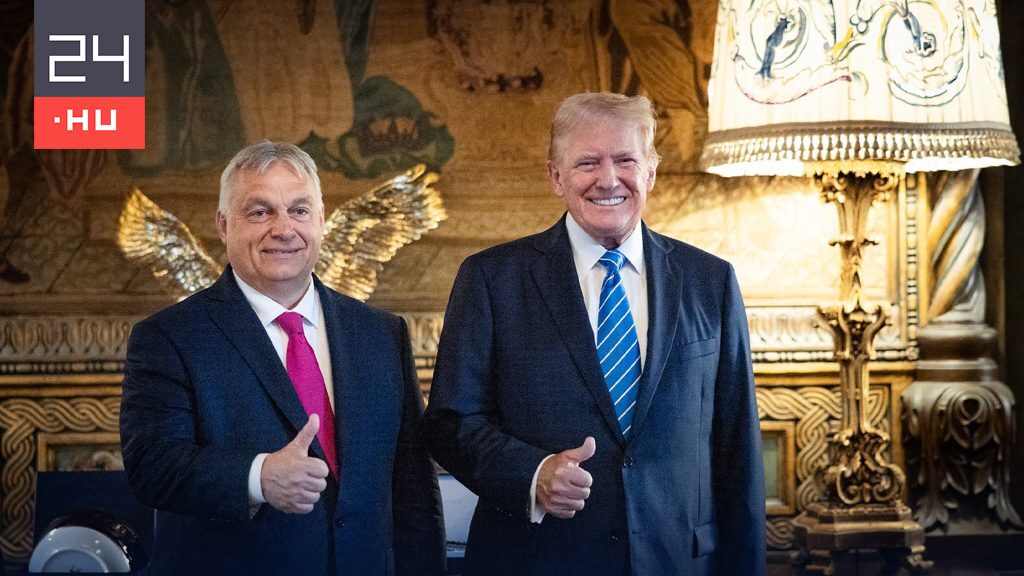

The measures will apply to fuels produced directly in Russia, such as diesel and jet fuel, but not to products refined elsewhere in Russia from crude oil. However, the European Commission has not yet been able to change its proposal: the Hungarian government, led by Viktor Orban, has already vetoed the initiative, and Bulgaria and Slovakia have reservations about the proposal. Brussels’ executive put forward a new proposal to reluctant member states on Friday.

Thus, diesel from an Indian refinery fueled by Russian crude oil qualifies as Indian diesel

– He gave a concrete example to Van Beurden, who noted that Shell, the largest oil trader in the world, does not deal with Russian partners and does not buy crude oil from the country on the spot markets. The company also plans to end its long-term Russian contracts by the end of the year.

The energy giant may write off up to $5 billion in assets after its exit from Russia’s oil and gas sector.

(Cover photo: Oil refinery in Volgograd, Russia, April 22, 2022. Photo: REUTERS Photographer/file photo)