It’s “annoying” – let’s say if sour cream costs twice as much at the convenience store than last week, we are “disturbed” if we run out of 95 gas at the gas station, and it can also be just as “annoying” when the government, from day to day, reduces From reducing utilities, eliminating kata, implementing solar panels, and socially restricting those in need.

But nothing is more “disturbing” than inheriting billions of dollars – at least according to Marilyn Engelhorn, a German woman living in Austria who inherited an enormous fortune from her grandparents.

What do you prefer to pay as taxes?

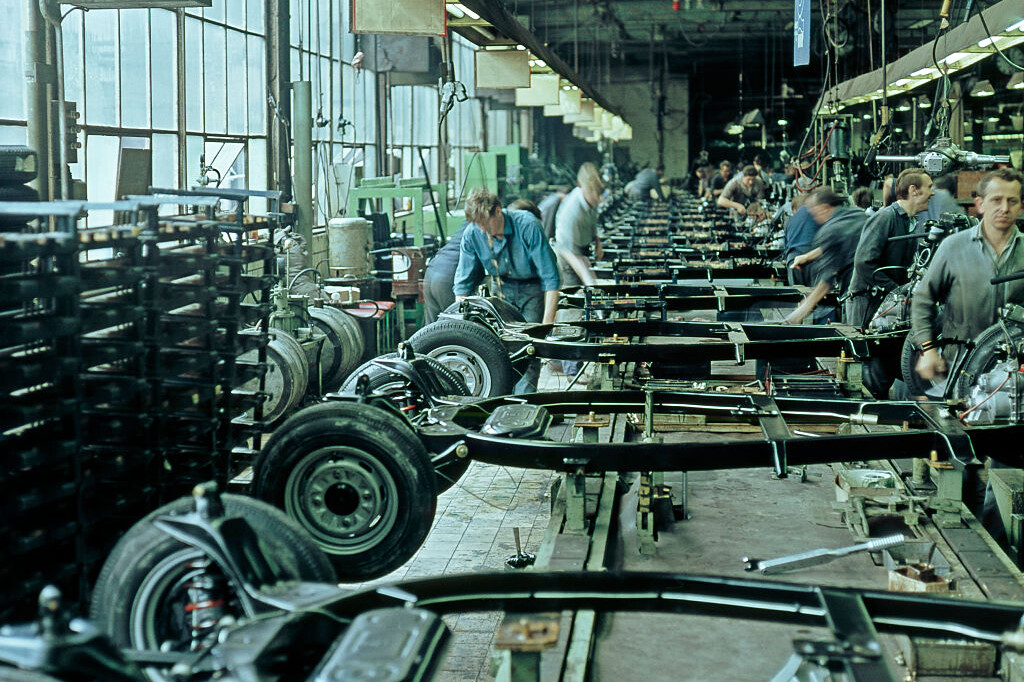

According to a New York Post article The Engelhorn family’s multi-billion dollar fortune comes from the chemical company BASF founded by Frederick Engelhorn in 1865. According to Forbes, the family’s net worth is estimated at $4.2 billion. Marilyn could not complain either: she grew up in a castle in Vienna and went to a French school. According to him, he lived a privileged life and saw the world “with a very narrow perspective.” In college, he began to think about wealth and its distribution in a completely different way. In September of this year, he found out that he would inherit a portion of the family fortune after his deceased grandmother.

“The dream scenario is to be taxed,” said the 30-year-old, who sees wealth as a burden rather than a blessing. To complicate matters, Austria, where Engelhorn also lives, decided in 2008 to abolish the inheritance tax. So she founded Tax Me Now, a group of wealthy people who want to redistribute wealth by taxing the rich in Germany and Austria more.

The heiress says that she did not earn the money, so she does not deserve it, and it should be democratically redistributed. According to him, donating it would also not be a good solution, since in this case he will be able to choose the organization to which he will give property, serving only the interests of the chosen group.

“I would like tax justice to bear the burden of this impossible decision on my shoulders,” he said.