In the draft obtained by Reuters, the World Bank presents its proposals for turning the financial institution over to member states that exercise ownership rights. These include shifts in lending policy, expansion of development loans and financial guarantee programs, and increased participation of private capital in World Bank-financed projects.

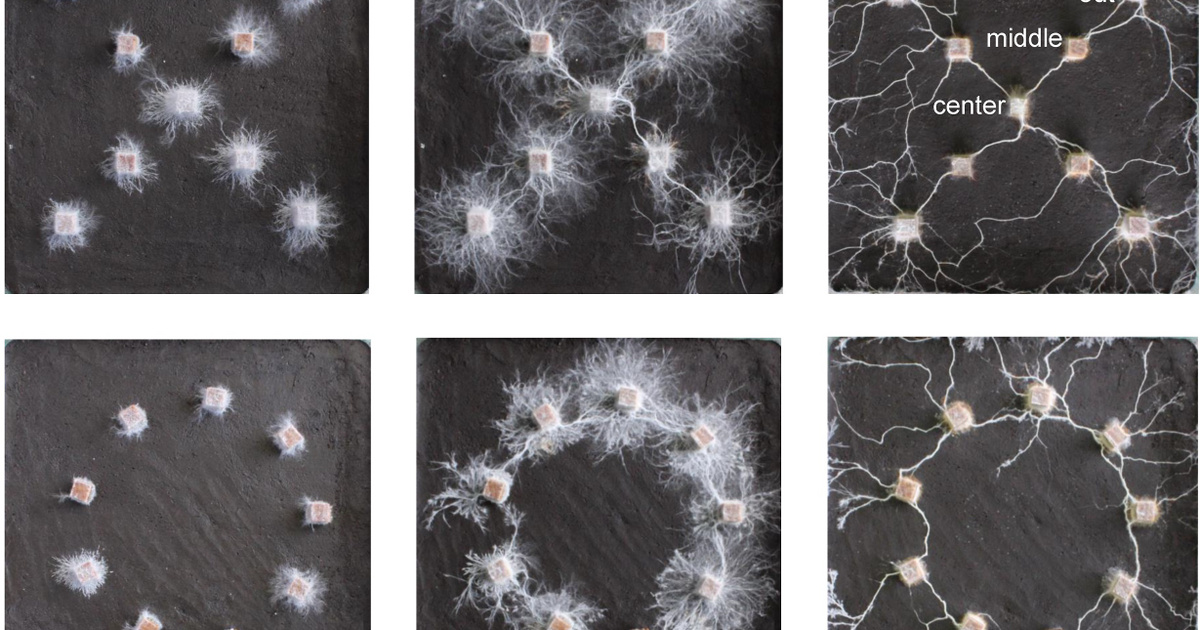

In the document, attention was drawn to the fact that investments to be made in the areas of climate change, healthcare and food security require additional personal and financial resources, which necessitates an increase in capital. In real terms, they wrote, the bank’s finances decreased by 3 percent compared to 2008.

US Treasury Secretary Janet Yellen called for a review of the World Bank’s business model in October.

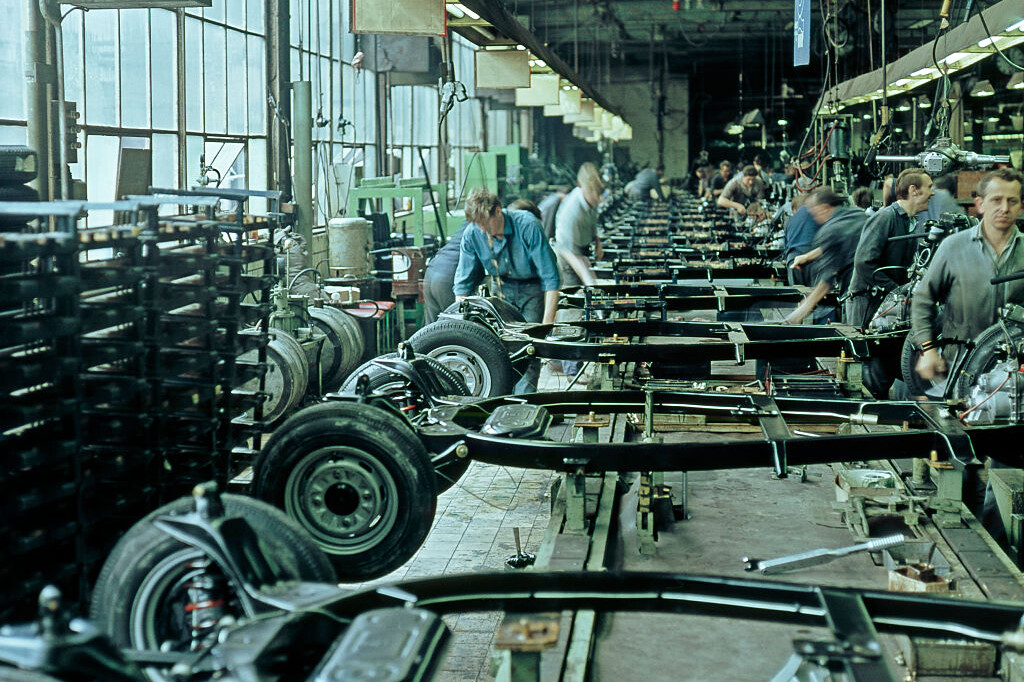

The organization’s lending policy has traditionally focused on financing individual country projects, but large investments in energy infrastructure, such as the development of renewable energy sources, represent excessive financial burdens for individual countries, while bringing global benefits. For similar investments, borrowers should be burdened with lower financing costs – Yellen was quoted as saying by Bloomberg.

The US Treasury declined to comment on the draft detailing the switch to Reuters news agency. The United States currently has the largest share in the World Bank’s ownership structure, at 16.7 percent, followed by Japan at 7.9 percent and China at 5.6 percent.

In 2018, World Bank shareholders decided to raise $13 billion in capital for one of the Bank’s credit institutions, IBRD (International Bank for Reconstruction and Development). The International Bank for Reconstruction and Development finances large-scale investments in infrastructure. However, they warned that the fund could run out of resources by mid-2023, so recapitalization is necessary.

The World Bank expects additional financial contributions from countries around the world to the International Development Association (IDA), a trust fund set up for the world’s poorest countries.

Plans also include creating a new development fund for middle-developed countries, modeled on the operating model of the International Development Association. According to the idea, projects aimed primarily at developing public services will be funded through private capital contributions.

The World Bank’s Development Plan will be presented in the first round from April 10-16. It can be discussed by representatives of member states at the general meeting to be held in Washington. Reuters wrote that the joint committee of the International Monetary Fund and the World Bank and the Development Committee of the International Monetary Fund and the World Bank could decide on recapitalization and change lending policy in the fall.

Cover image: Getty Images