The US Sanctions Authority has launched an investigation into Raiffeisen Bank’s business activities in Russia. The Austrian lender plays an important role in the Russian economy.

asked the financial institution Reuters I confessIn January, it received a request from the US Treasury Department’s audit office, OFAC, “to clarify Raiffeisen Bank International’s payment business and related operations in light of developments relating to Russia and Ukraine.”

One of the news agency’s sources said that OFAC requested details of Raiffeisen’s exposure in Russia, partially occupying Donbass, Ukraine and Syria, including the transactions and activities of individual agents.

The US agency requested a response by February. Raiffeisen’s lawyers asked for an extension of the deadline and promised to answer all questions in three stages: at the beginning of April, May and June.

We will continue to cooperate with the US authorities, – noted the representative of the bank, who said that the order was not triggered by a specific transaction or business.

The bank itself manages compliance with sanctions with appropriate procedures.

An OFAC spokesperson said it was “confident that the information provided to OFAC will meet the request,” which is “of a general nature.”

Raiffeisen has not been penalized before. However, the January information request worried European financial regulators responsible for supervising the bank, because it could eventually lead to sanctions against Raiffeisen, two people with direct knowledge of the matter said.

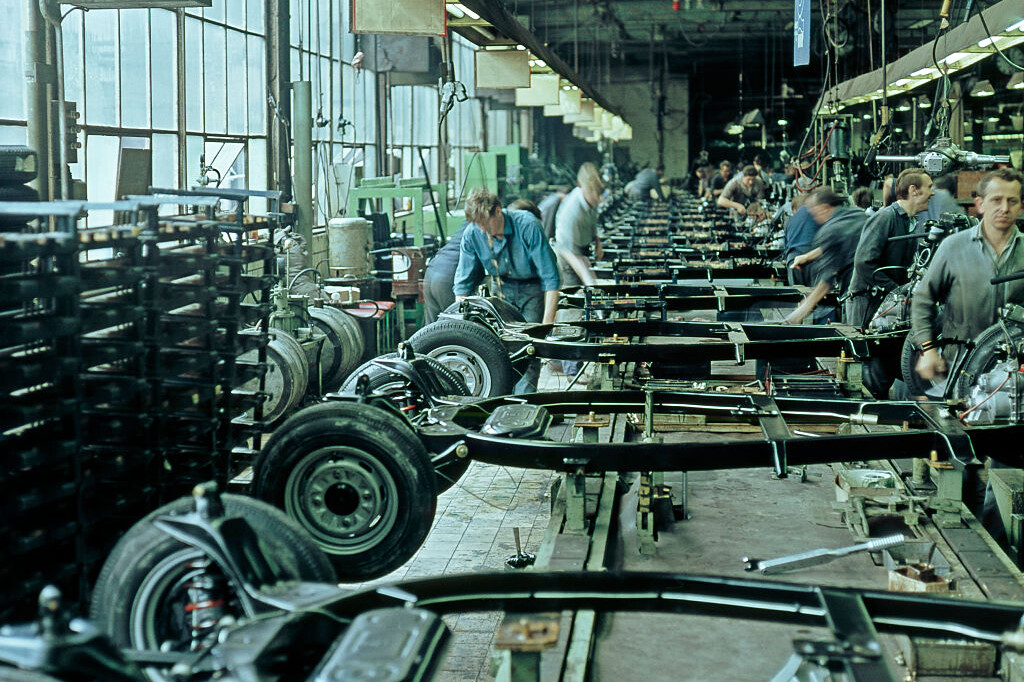

Raiffeisen never left Russia

Raiffeisen is deeply rooted in the Russian financial system. It is one of the two foreign banks that the Russian Central Bank considers thirteen “systemically important credit institutions”. This indicates its important role in the Russian economy, which suffers from comprehensive Western sanctions.

As the second largest lender in Austria, the bank also supports the economy of its home country, while carrying out extensive activities in Eastern Europe. An Austrian official said that Austrian authorities are closely monitoring Raiffeisen’s situation and activities in Russia due to the bank’s importance.

A year after Moscow launched what it described as a “special military operation” invasion of Ukraine, Raiffeisen is one of the few European banks left in Russia.

Because of this, he faced criticism, including from his investors. The bank has previously defended itself by saying its exposure to Russia was limited.

Last year, Raiffeisen posted a net profit of around €3.8 billion, thanks primarily to a €2 billion profit from its Russia business. Russian depositors have deposited more than 20 billion euros in the bank.

Washington rarely resorts to brutal means

The US Treasury Department can sanction those who violate the sanctions. In its toughest sanctions instrument, it freezes US assets and prevents banks from accessing US dollars, which are critical to international trade and finance.

With the most powerful sanctions tool in OFAC’s arsenal, the so-called Designated Contact List (SDN) can be used to freeze US-based assets, ban US companies or citizens from trading with individuals on the list, and exclude a bank or individual from all transactions denominated in dollars.

Alternatively, OFAC may resort to less drastic measures, such as imposing fines or issuing warning letters for sanctions violations.

Two former US officials, speaking on condition of anonymity, said Washington has usually been reluctant to take tough action.

OFAC often requests information from banks, but this does not automatically lead to sanctions, German sanctions lawyer Victor Winkler said, however, he did not wish to comment specifically on the Raiffeisen investigation.

“not a sausage holder”

OFAC has so far imposed sanctions on five large Russian banks, including the state-owned Sberbank, as well as the Russian oligarch, in response to its invasion of Ukraine.

Shortly after Russia invaded Ukraine, the United States banned Sberbank from the American financial system. Its European division, headquartered in Vienna, was shut down shortly after, even though it had previously claimed that the sanctions would not significantly affect its operations.

Five years ago, in 2018, the US Treasury Department sanctioned Latvian bank ABLV for illegal activities, most likely linked to Russia, which led to the bank’s quick dissolution.

In March last year, the CEO of Raiffeisen told shareholders that he was considering options for the Russian business.

But Johan Strobel said it takes time to make a decision because the bank is not a “hot dog stand” that can be closed down overnight.

(Cover photo: Raiffeisen Bank branch in Moscow on February 27, 2016. Photo: Maxim Shemetov/File photo/Reuters)