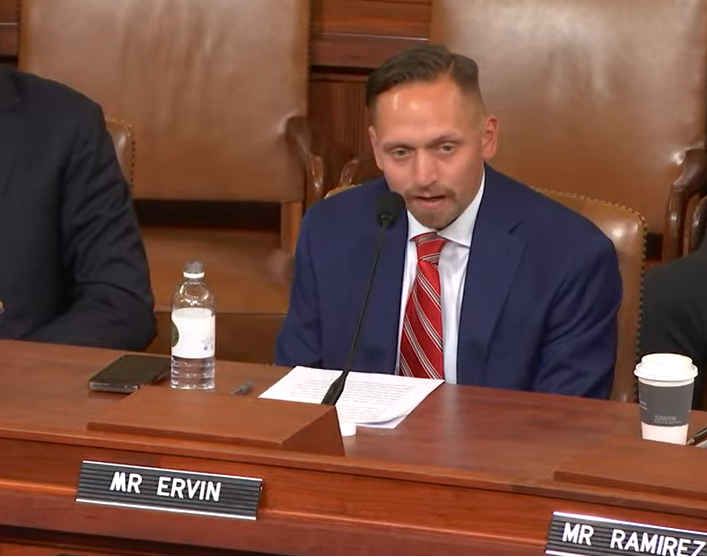

The member for West Virginia gave testimony on the importance of the small business deduction

Make the small business deduction permanent before it expires at the end of 2025 NFIB's highest priority NFIB member Michael Irvin testified before a U.S. House of Representatives Ways and Means Committee hearing on April 11 about the importance of making the small business deduction permanent.

“Right now, we employ over a dozen people in our community,” Michael said. “Additionally, I train and train several other Main Street business owners throughout my area… [the Small Business Deduction] It allowed me to deduct up to 20% of my business income, allowing me to invest in my business, my employees, and my community. I was able to increase my hourly wages, invest in equipment, grow from one location to three locations, create a mobile location, and sell my Main Street roasted coffee globally.

Michael is the owner of Coal River Coffee Company in St. Albans, West Virginia. In his testimony, he noted how the 2025 deadline already impacts his future business decisions. “Although the end of 2025 seems far away, I will soon have to make long-term business decisions based on future expectations,” Michael explained. “The lack of certainty surrounding my tax burden definitely makes long-term planning more complicated. I want to continue to grow my business, add locations, and increase wages for my hard-working employees, but that becomes more difficult when I have less money to reinvest in my business.” “

The small business deduction allows small businesses organized as pass-throughs (S corporations, sole proprietorships, or partnerships) the ability to deduct up to 20% of qualified business income and is set to expire at the end of 2025. Tax certainty law on main street That would make the small business deduction permanent.

“In two years, if my taxes go up, my corporate tax rate will still be 21%,” Michael noted. “Tim Hortons will pay a federal rate of 21% and a state corporate rate of 6.5% for a total combined rate of 27.5%, while the total combined rate will be closer to 45%… I'm not asking for special treatment, but I'm asking that businesses be treated Small businesses are on equal footing with large businesses and are not placed at a competitive disadvantage under tax law.

More information about the small business deduction is available at smallbusinessdeduction.com. Take action: Join your fellow small businesses across the country by adding your name to our petition to prevent a massive tax increase at the end of 2025.

Take action