After Monday’s announcement of the accusations against rivals Binance and its founder Changpeng Zhao, Coinbase shares suffered a massive 9% drop on Monday — and at the same time bitcoin took a hit, too. Today, there was a further drop after it became public that Coinbase had been sued by the supervisory authority, and the listing is currently down 17 percent.

SEC Chairman Gary Gensler has criticized the operation of the trading platforms, saying they perform multiple functions while referring to themselves as exchanges. Gensler drew parallels with traditional financial institutions, noting that the NYSE does not operate hedge funds either.

According to the SEC complaint, Coinbase’s brokerage, exchange and storage software violates securities laws. The regulator accuses the company of circumventing regulatory structures and failing to comply with disclosure requirements under US securities law. According to the SEC, Coinbase has made billions of dollars in cryptocurrency transactions since 2019 while circumventing disclosure requirements intended to protect investors.

The lawsuit addressed several aspects of Coinbase’s business, including Coinbase Prime, which transmits orders; With Coinbase Wallet, which gives investors access to their liquid assets – as the name suggests, it’s a crypto wallet service; And Coinbase earn through the staking service (in short, a cryptocurrency deposit for which the customer receives interest).

In his statement, Gensler stressed that Coinbase, while subject to securities laws, has illegally integrated and offered exchanges, brokerages, and clearinghouse functions. According to the SEC, Coinbase was fully aware that its business was subject to federal securities laws but ignored them.

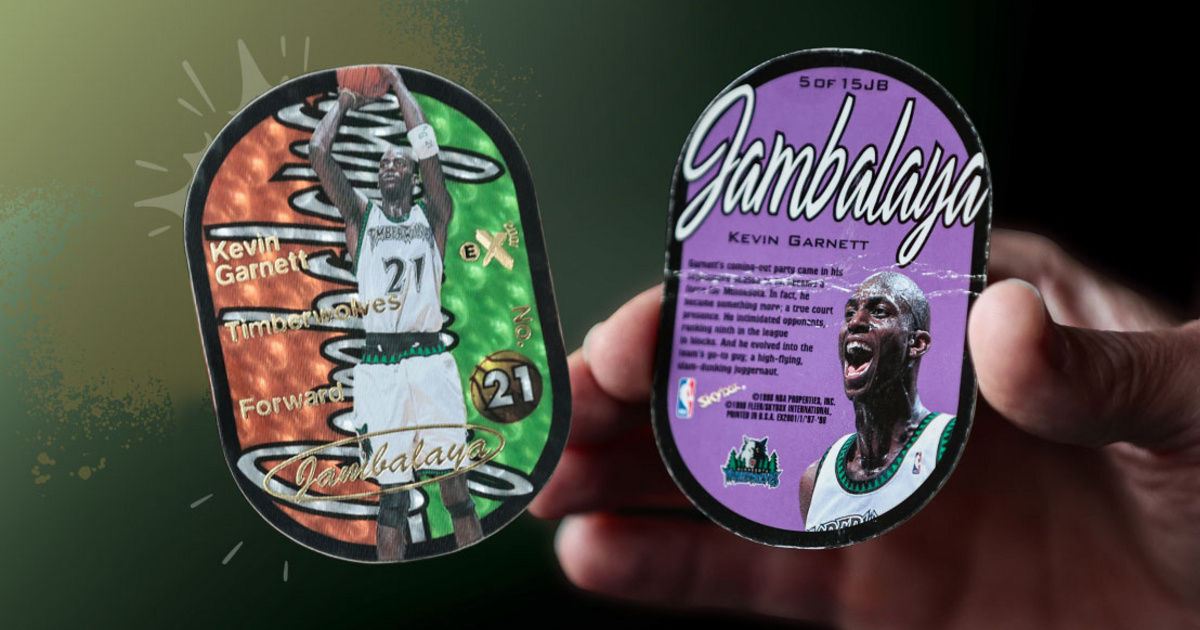

Cover image: Getty Images