At the first general meetings of American companies in 2023, support for environmental and social aspects among investors has fallen sharply, because in addition to uncertainty about the global economy, strict regulations and political pressures are leaving their mark on business, he wrote. financial times.

In corporate America, petitions calling for action to protect the climate received shareholder support of an average of 23 percent by the end of May this year, compared to 36.6 percent last year.

—according to data from the nonprofit Foundation for Sustainable Investments. Likewise, investor proposals on human rights weakened, receiving only 21.6 percent of the vote, compared to 2022, when more than a third of investors supported them.

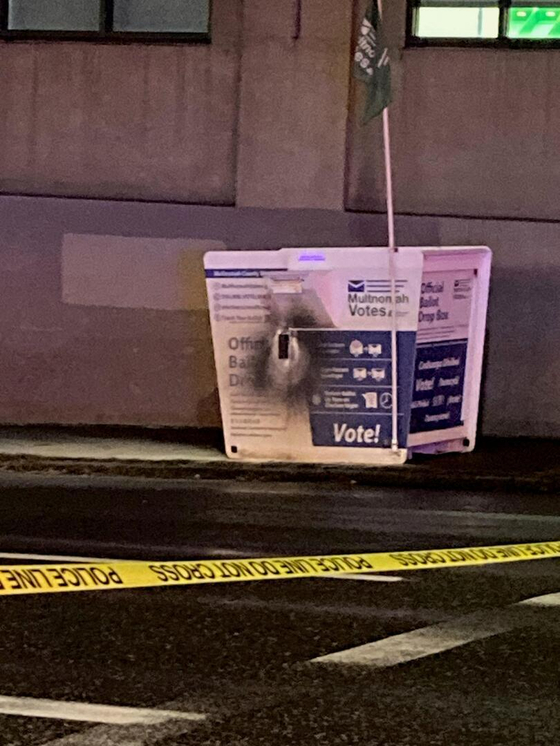

Shareholder proposals, which are generally non-binding in the United States, are increasingly becoming a vehicle for activism by religious organizations, environmentalists, and other socially engaged investors. According to data from the Conference Board and the Esgauge Research Group, they expect a record number of submissions this year, but based on the published data, it is questionable whether they will be taken seriously.

The number of petitions is constantly growing, but they are being carried out less and less. According to the Institute for Sustainable Investments, only five US shareholder resolutions related to environmental and social issues garnered majority support this year, far fewer than in previous years.

Just 11 percent of Exxon shareholders supported a petition last week to set emissions-cutting targets in line with the Paris climate agreement, compared with 28 percent last year. At Amazon, less than a third of shareholders supported a decision requiring more information about the dangers of plastic packaging, compared with nearly half a year ago. At shipping company UPS, support for the Diversity, Equity and Inclusion proposal was 25 percent this year, much lower than 37 percent in 2022.

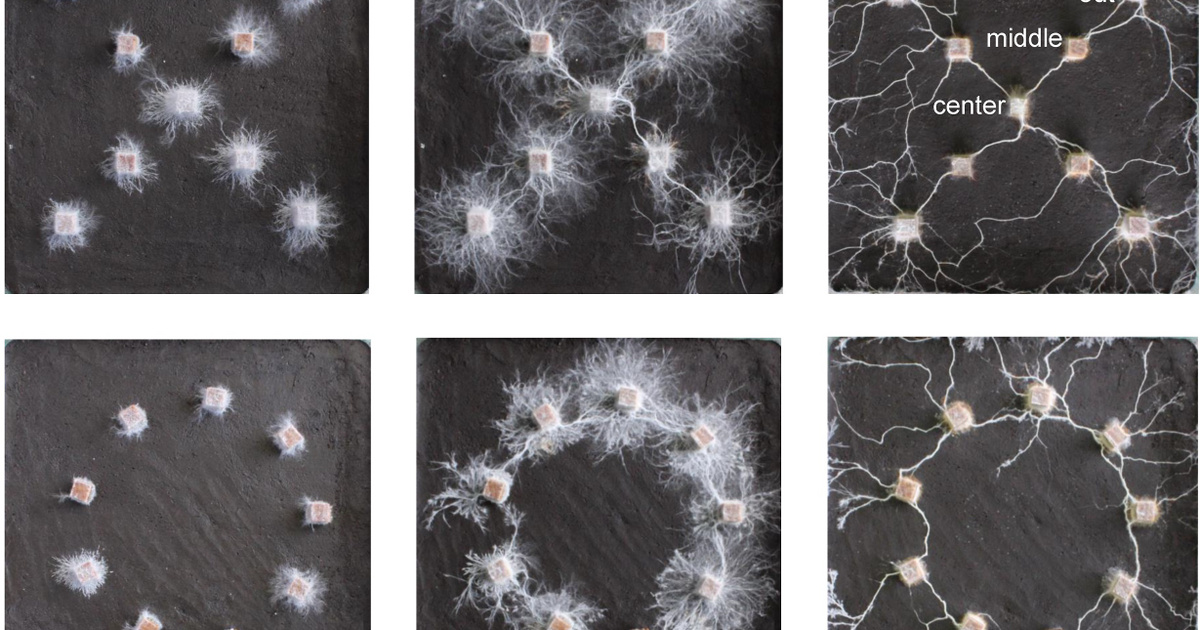

And although such initiatives were not as intense as in the United States, they also lost momentum among European companies.

According to data provider Diligent, average support for environmental and social proposals among EU companies rose from 10.6 percent last year to just 11.6 percent in 2023.

True, fewer shareholder proposals have been submitted in Europe – as of May 31, only eight petitions have been put to a vote.

Support for environmental and social decisions outside the European Union and the United States reached 17 percent this year, compared to 11.3 percent last year.

Shareholder proposals are increasingly prescriptive, but the organizations that submit them are not willing to accept that what they want to do, whether commercial or social, doesn’t usually work. And this leads to the fact that other investors also turn away from them, since their activities have a negative impact on companies

– said Brian Bueno, Farient Advisors employee.