The obligation to submit invoices issued online – along with many other legal measures – has dramatically cleared the economy, and increased state tax revenues dramatically. According to a NAV statement, since the commitment began, nearly 2 billion invoices have been received in its system, a large portion of which were sent automatically by invoicing software.

From the corporate and corporate point of view, invoice management, which appears as an additional burden, actually increases the efficiency of those who take advantage of the potential inherent in the invoice data available online.

“The IRS has made it possible, among other things, to collectively query submitted invoice data via a machine-to-machine interface, ensuring that companies can automate and create useful additional functions and processes with a now mature system. Although technically the online calculation system is more From a simple obligation to provide data, according to our experience, Hungarian SMEs are still largely unable to exploit the automation capabilities inherent in the system, and even the implementation of the reporting obligation often “causes problems, which continues to impose a serious administrative burden on corporations,” István Raques, consultant and tax expert in BDO’s Business IT Services Division, noted earlier.

Account data flow cannot be in one direction only.

The IRS has made it possible to query submitted invoice data even in bulk via a computer interface, providing companies with the option of automation. In addition, all invoices are displayed in a unified data structure in the NAV database, regardless of their data source. Thus, companies do not need to manually extract data from different invoice formats and standardize the formats, as the data can be uploaded to the systems in real time, which reduces the resources allocated for this and the possibility of errors. In the background, mass account data synchronization can also be initiated using the NAV database, further simplifying corporate account management.

However, the presence of account data alone does not meet the requirements of the accounting law!

Although integrating data retrieval into a company’s billing management processes is very easy, the invoice acceptance process should never be so automated that we forget to deal with physical or electronic originals. Account management limited to the existence of the specified account is not sufficient because all related NAV data is available. The accounting law is very clear, and the original documents must be behind the accounting records.

What does it mean to simplify account management software in everyday life?

With software support for invoice management, it is possible to standardize different invoice paths, standardize different invoice formats without manually recording data (for this you need a NAV data connection), and you can also create an invoice database where relevant documents can be extracted with quick access (eg performance certificates and contracts). A company that also arranges items using software implements software billing management at a higher level than this, further reducing the time spent on manual billing management.

The process requires software that can also download NAV data at the item level and then convert it into relevant information from an accounting point of view.

Organizing items is done with a few clicks, and the program should automatically do the necessary calculations and check for totals. This makes it possible, for example, to select 50 invoice items containing pencils, pens and paper with just a few clicks, summarize them and convert them as stationery charges. ERP software is not capable of this electronic regulation, but some destination management systems (DMS) are.

Basically the restructured invoice data can be transferred to any software with which the company’s DMS system has been integrated. For example, an invoice of more than 100 items can be sorted into 3 different projects during the approval process without burdening the approvers with thousands of clicks and calculations. Error is excluded, as the calculation is done by the software. Thus, invoice data is managed at the item level in the DMS system, where invoices are also routed, a unified invoice record is created, and invoice approval is managed.

How do DMS systems support the growth of the company’s business results?

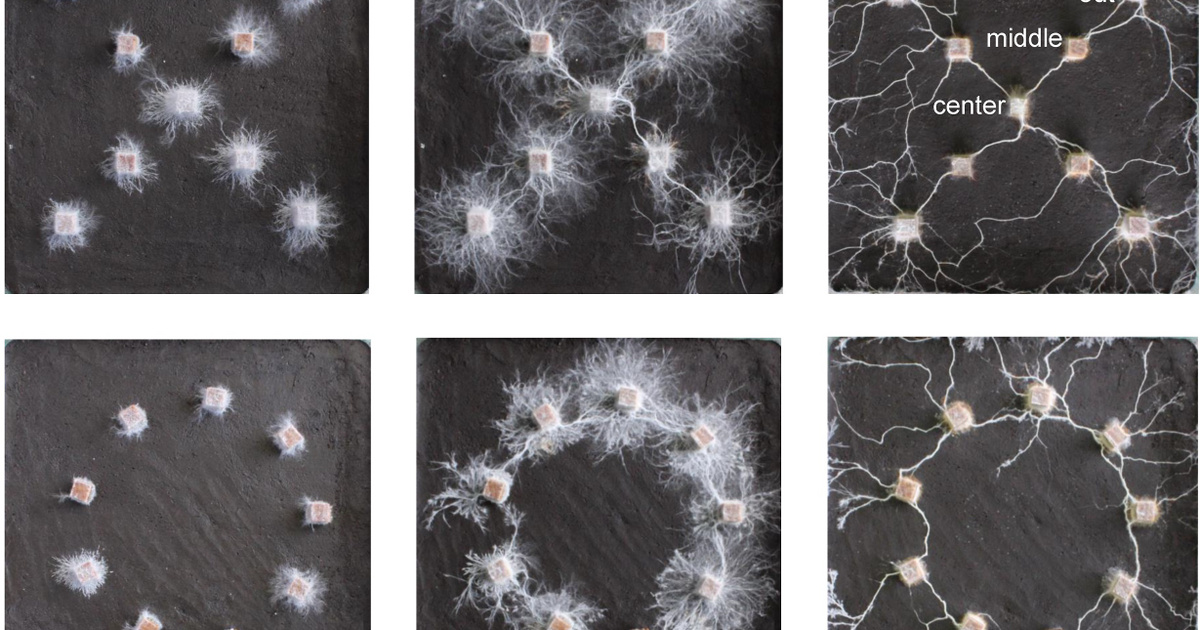

Corvinus University in Budapest, and Istvan Cecchini University common researchthein The effectiveness of digital corporate management systems was examined for 315 companies with annual sales between 1 and 50 million euros. In the research, they were interested in how the use of certain systems affects a particular company’s business results. ERP, CRM (enterprise customer relationship management), DMS (document management), WF (workflow i.e. business process control), BI (business intelligence) and software bot systems and solutions were examined in the survey.

The aforementioned digital solutions improve the efficiency and effectiveness of businesses, help make operations transparent, and facilitate effective monitoring of tasks, documents, and processes. It also enables the employees to participate in higher value adding activities thus creating more value. The question is, will all this be reflected in the company’s profits?

The results of the research clearly show that DMS contributes significantly to the company’s profitability (in addition to the regulatory variables), that is, it leads to a clear increase in efficiency.

The result of the application of ERP systems is not great, which suggests that “it is too late”; Its offering does not, in and of itself, constitute a competitive advantage. The added value of ERP systems appears in storing data that describes the company’s business (such as accounting data, inventory records and raw materials), not in managing business processes, which requires a more complex ecosystem to run the company.

The DMS program is the basis for the real management of the company.

WF and BI systems are not yet widespread, but the company cases generated during the research showed that this will change significantly in the coming years. The process-based enterprise management system, developed from document management systems, with the support of business intelligence, rightfully claims the title of the new fourth generation of enterprise management systems. Such systems provide the necessary ecosystem for management, and those who start implementing them at the right time can gain a significant competitive advantage.

Development plans related to NAV bills

Thus the online net asset value calculation system is much more than a simple platform to fulfill the obligation to provide data, where the greatest potential lies in the data that can be retrieved. However, according to experience, especially in the local SME sector, few people take advantage of the opportunities inherent in this. However, the IRS does not stop there, as it continues to develop solutions that enhance electronic invoicing, primarily NavXML.

“It has been almost two years since the launch of the NAV Online Invoice 3.0 system, and therefore taxpayers must report their invoices based on the new 3.0 xsd system. Since the reported XML file can also be used as an electronic invoice in the new system, more and more companies It turns to this solution in a B2B relationship, since it can issue invoices in such a way that it simultaneously fulfills its legal obligations in terms of reporting.The Tax Authority greatly facilitates the work of taxpayers who want to use electronic invoices, since their only task is to indicate the format of the invoice when submitting The data, that is, it is an electronic invoice, indicates that the provision of the data is also an electronic means – the invoice, and they must be provided with the appropriate hash codes” – they said PWC Experts.

The tax office development application raises the question of whether online invoicing software will be needed at all in the future.

Not only account data can be queried from NAV, but also various partner data. In addition to the classic tax number check, there is also a lot of other information available, for example, it is easy to see if the partner has moved to a different address, has become a member of a VAT group, but the tax office is We are also expanding the data Which can be queried in business enterprises with various blacklists. Thus, in the near future it will be possible to find out if our partner owes a large amount to the tax office.

This is important information, because it is not worth, for example, to agree to a subsequent settlement with this taxpayer or it is worth looking for new, more reliable partners.

Cover image: Getty Images

The article was published by Dms and i visited. endorsed it.