09/29/2023 at 2:00 pm

For the sake of comparison, we focused primarily on organic operations, so if not indicated separately, we analyze the numbers without acquisitions.

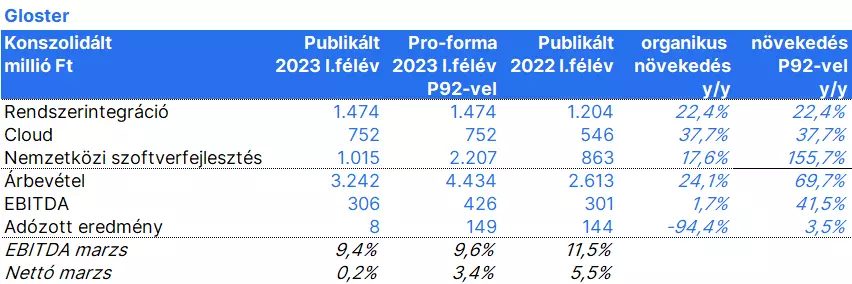

The dynamic growth of the company’s sales continued in the first half of this year. Without P92, sales increased by 24% and, taking P92 into account, by almost 70%. The proportion of regular income within sales revenue remained around 65%, but with P92 it is already 73.1%, so the 75% set for 2025 has been practically achieved. The export rate increased slightly, from 28.4% to 29.1%, but with P92 it has already reached 45.2%, exceeding the 2025 target.

Although sales revenue increased, EBITDA remained practically stagnant (306 million HUF), and profits after tax almost completely disappeared, amounting to only 8 million HUF. Seasonality is strong in the company. As a rule of thumb, it is useful to calculate that one-third of EBITDA is generated in the first half of the year, and two-thirds in the second half. Furthermore, it appears that in the case of P92, earnings generating capacity is more concentrated in the second half of the year. .

The deterioration of the profit ratio can be partly attributed to one-time items. Non-recurring costs related to the integration of the ten acquired companies, the transition to IFRS and the preparation of the exchange class change exceeded HUF 100 million. These things will not be repeated next year, and their negative impact may be much less in the second half of the year as well.

Another factor is that employee expenses rose by 52% even without the impact of the acquisition. If we assume that the one-time item of 100 million was largely reflected in wage costs, the increase in wage costs is still about 37%, which far exceeds the increase in sales revenue of 24%.

The reason for this is, on the one hand, the general wage inflation, which is particularly strong in the IT sector, and on the other hand, the fact that Gloucester strengthened the middle management team in order to merge companies.

The company still plans to change the category this fall, namely to move the stock to the BÉT Standard category. The company is increasingly trying to open up to foreign markets (USA, UK, Scandinavia). Management sees an improving trend in overseas markets. The current focus is on increasing efficiency and leveraging synergies.

Source: Company data, Erste

Following the half-year results, we see that with the acquisition of P92 this year, Gloster will exceed our 2023 EBITDA forecast of 1.2 billion, as we did not expect an acquisition for this year.

However, if we look at organic operations without acquisitions, we find that things have gone less favorably than expected, and the company’s result without acquisitions this year is expected to be lower than our expectations, partly due to non-recurring costs and partly due to the jump in expenses. Individual.

Moreover, the latter are constantly integrated into costs, which negatively affects profitability. (Source: ERSTE)