All over the world, even in our country, analysts reassure customers and those interested in finance by saying that the bank panic that started in America is really not justified, because the problem can be clearly identified and precisely defined, and in any case it is mainly the regional banks in Silicon Valley that suffer problems, mainly due to bond investments launched during the pandemic deposit boom. Which was devalued by the Fed’s aggressive rate hike. For crisis management, it is sufficient to limit deposit withdrawals and transfer the money flowing from deposits to large banks to smaller banks.

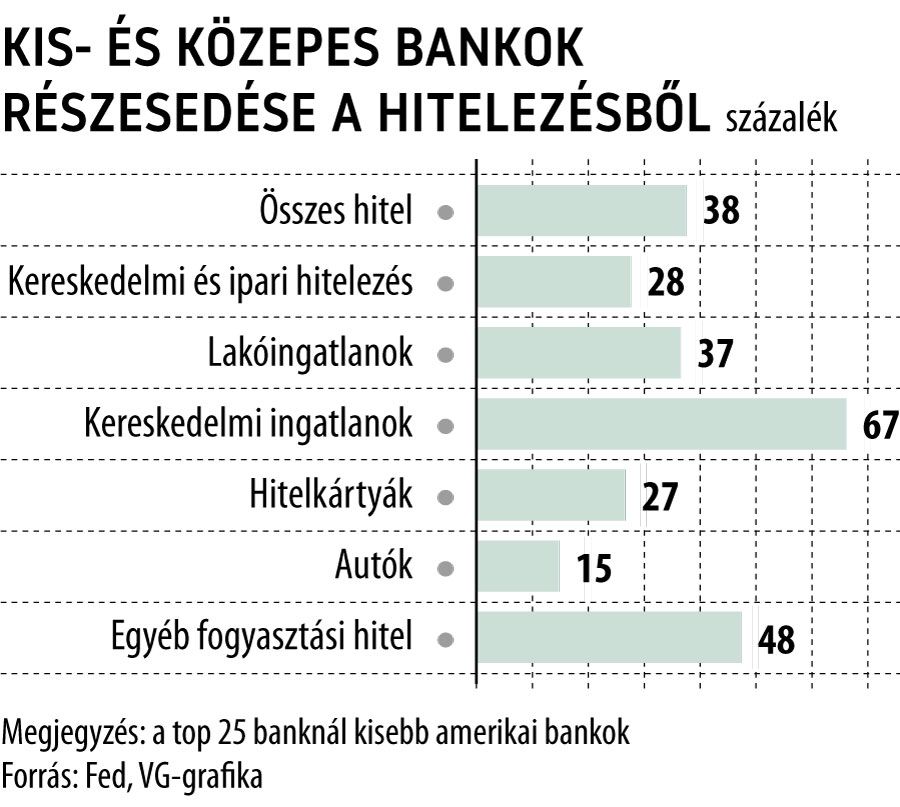

The argument that seems suspiciously good can be bracketed by the risk of a secondary recession. The bankruptcy of SVB and Signature Bank as well as the $100 billion bailout of First Republic is creating uncertainty in the financial institution that handles 38% of US lending and 67% of commercial real estate lending.

During the subprime mortgage crisis of 2008, major banks were recapitalized with the help of the state and forced to merge, creating the safe upper level of the American banking system. At the same time, most of the risks are embodied at the lower level. Now there is a fear that distrust of small and medium-sized banks will constrain lending to the point that the US economy will slide into recession.

Smaller banks are likely to respond by tightening borrowing rules and slowing lending to improve their capital adequacy ratios

said Torsten Slok, senior analyst at private equity firm Apollo Global Management. It will be much more difficult, he added, to get a car, consumer or office mortgage, simply because regional banks will be busy fixing the balance sheet.

As a result, the US economy is already in recession by the middle of the year,

It is caused by the narrowing of the lending activities of smaller banks. Until SVB’s bankruptcy, Slok predicted a soft landing at the end of the Fed’s rate hike period. Now you see you need to fasten your seat belts because a hard landing is about to happen.

Economists at Goldman Sachs raised the probability of the US economy entering a recession within the next 12 months to 35%,

Whereas before SVB went bankrupt, they only gave this scenario a 25 percent chance.