WarnerMedia and Discovery Inc. As a stand alone global entertainment and media company, with the name of the new company announced only next week.

WarnerMedia is the entertainment and media group owned by AT&T, one of the world’s largest media companies. Silver Spring-based Discovery is a global leader in reality-based entertainment, with high-quality curiosity-satisfying content, entertaining and informing your audiences on all screens and platforms.

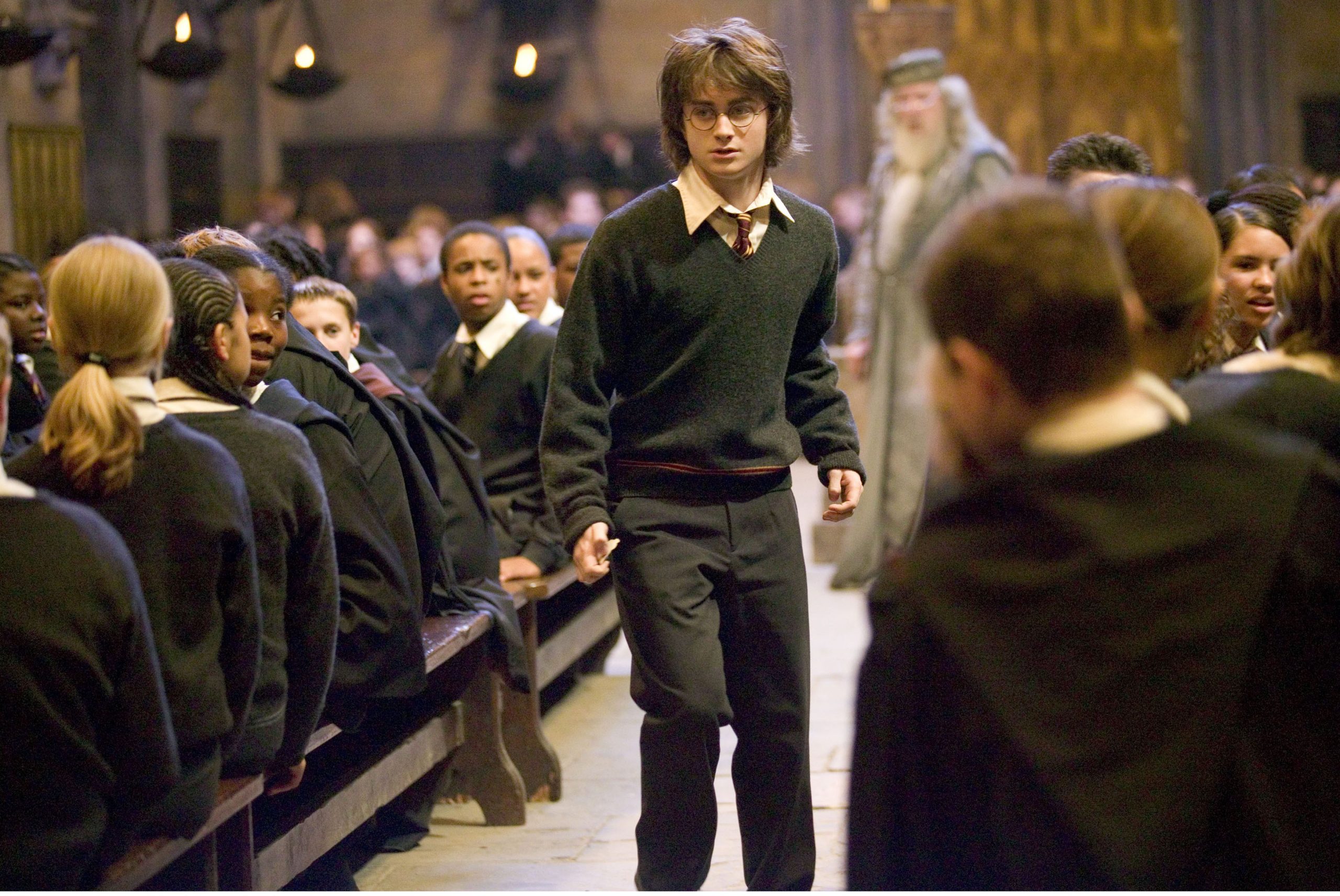

The two companies said Monday that Discovery CEO David Zaslav will lead the new company, which includes one of Hollywood’s most powerful studios, including the Harry Potter and Batman franchises, CNN news, sports shows and in-house Discovery. Travel, natural and scientific presentations.

The new company will be 71 percent owned by AT&T shareholders and 29 percent by Discovery investors. Together, you will spend about $ 20 billion producing content, more than the $ 17 billion that Netflix, the world’s leading streaming provider, has spent this year. The new company is expected to generate approximately $ 52 billion in revenue next year. Adjusted EBITDA could be around $ 14 billion, and synergy could save $ 3 billion in costs.

The deal is expected to expire in mid-2022, subject to approval by Discovery shareholders and obtaining regulatory approvals.Discovery shares rose 16 percent in pre-exchange trading, and AT&T shares rose 4 percent in New York. Two hours after the opening, AT&T shares were up 1.74 percent, up $ 32.80, and Discovery fell 1.80 percent, down $ 35.01.

Acquired by AT&T in 2018, WarnerMedia has acquired film production, operating television channels and publishers, and providing internet and telecommunications services. Its subsidiaries include HBO, New Line Cinema, and Time Inc. And Warner Bros. Entertainment, CNN, Cartoon Network, Turner Broadcasting System, and DC Comics. Discovery serves viewers in nearly 50 languages in 220 countries and territories, and its channels include Discovery Channel, HGTV, Food Network, TLC, Travel Channel, Animal Planet and Eurosport in Europe.

AT&T announced that it will use $ 43 billion in revenue from withdrawing its tax-exempt media assets to pay off more than $ 160 billion in debt. Analysts say the creation of the new company reflects an acknowledgment that TV viewers have switched to live broadcasts. Maintaining a leading position and being able to compete with competitors like Netflix and Walt Disney requires greater volume, access to capital, and a wide range of high-quality content.